One of the leading banking institutions in Europe.

One of the leading banking institutions in Europe.

The client has a customer service department dealing with a large number of queries. Their efficiency was limited by time-consuming processes and a heavy workload.

Monotonous and repetitive tasks were tiring and causing dissatisfaction. To improve the situation, the client looked for a way to optimize their operations and lower the pressure on the team.

What made the challenge tougher was that the organization operates in the financial industry. As a result, there are very strict regulations that apply to any technological solution.

Having discussed the requirements with the client, we learned that a large number of queries to the customer service team were repetitive. There was therefore a possibility to automate some of the replies and processes.

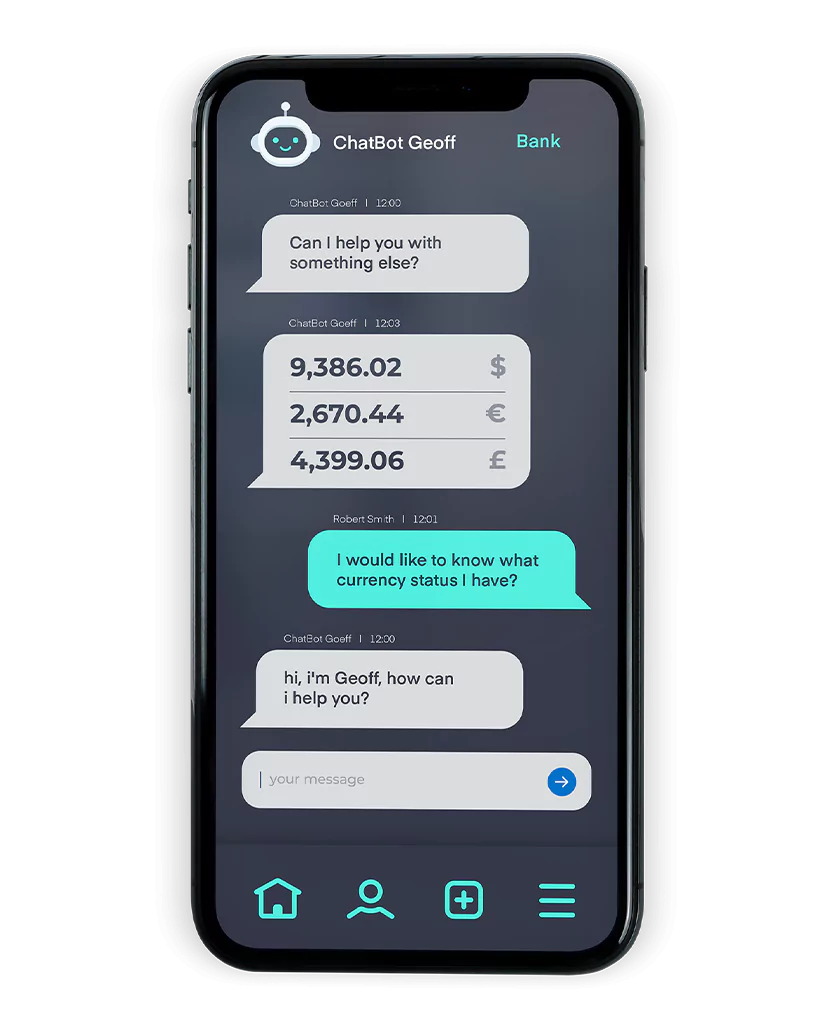

Automation would increase the resolution speed while simultaneously freeing up the team for more complex issues. Our recommendation was to use process bots, or chatbots.

The development process had several stages:

Before we could build the solution, we needed to conduct a deeper analysis of requirements. We focused on internal processes and regulations. To be able to leverage the chatbot in the best way, we needed to select the business processes that were repetitive and easy to optimize.

Once the process was selected, the bot had to learn a number of queries and additional related questions. The main goal of this stage was to minimize the path of the query. The bot had to report it accurately and escalate it to the right department while keeping the deadlines.

Another important aspect was to gather all of the details of the query, and ask supplementary questions if necessary. We set up a range of questions that need to be answered in order to assign the query to the right department. We also created numerous scenarios for a bot to be able to answer as many questions as possible.

The next step was to create the dialogue trees for personalized conversations. The bot was expected to be able to analyze the details provided by the customer and ask additional questions if any important details were missing.

Once these steps were completed, the MVP of the bot was released for further testing. The bot’s performance was measured with an accuracy indicator, reaching even up to 93%. This stage was very helpful and allowed us to eliminate inaccuracies, some of which could not have been predicted.

The bot is programmed in a way that allows for adjustment after the implementation, e.g. to support the sales process or present special offers. Additional features, such as small talk ability, can be developed.

Chatbots enhanced the customer experience by increasing availability and speeding up resolution time. Not only did they allow customers to have their queries answered outside of the standard office hours, but also provided immediate assistance.

The bots were also an opportunity to present offers and new products to customers interested in particular services. This led to increased sales of new products.

Moreover, bots helped to delegate tasks that required finding additional information for the customer for instance a cost or a particular number.

From the employees’ perspective, the elimination of mundane and repetitive tasks helped them to save time and allowed to focus on more engaging and complex queries, or on self-development. It made their work more satisfying.