US-based fintech provider, specializing in post-trade operations.

US-based fintech provider, specializing in post-trade operations.

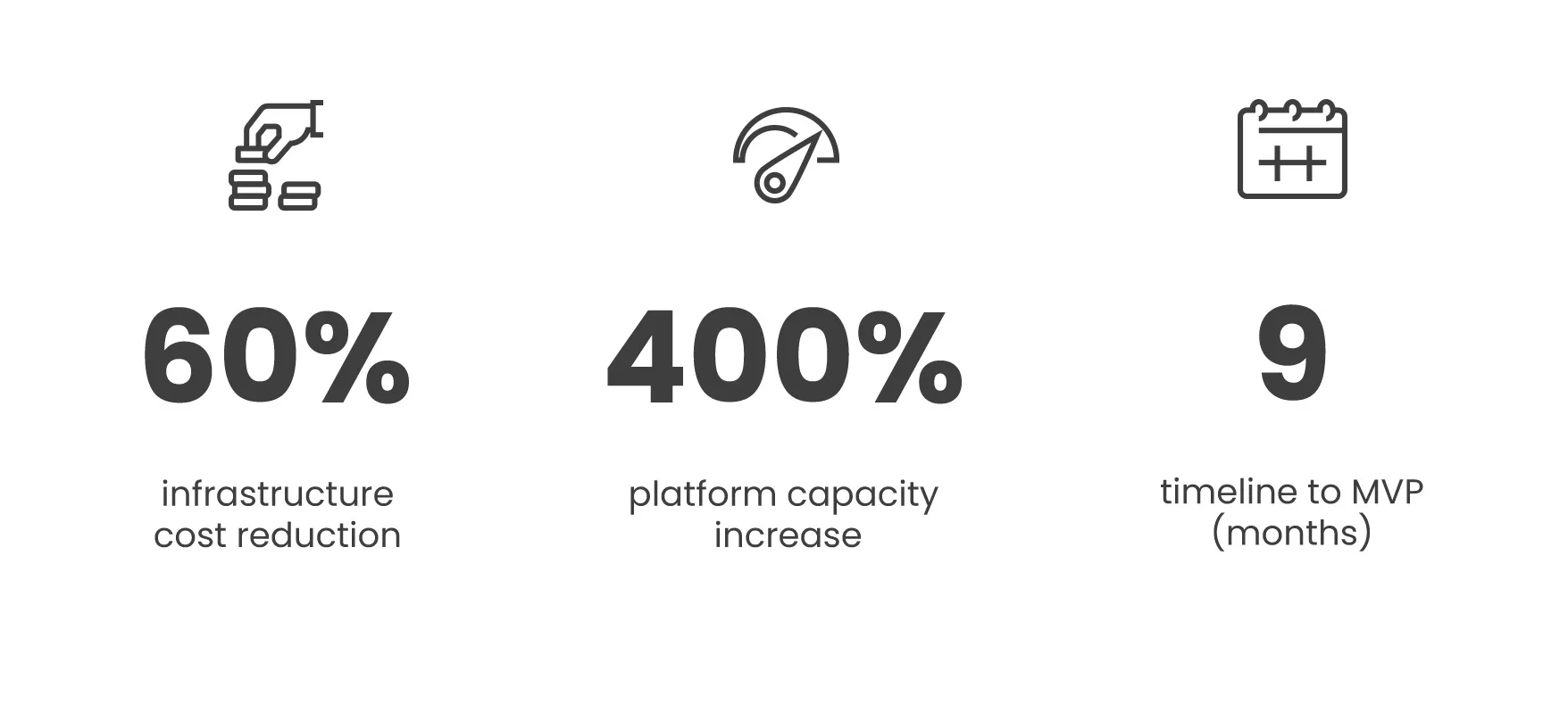

A leading provider of a post-trade automation solution embarked on a transformative journey with the Azure Data Platform. The strategic move to scale their business and remove technical debt resulted in 60% cost reduction and 400% higher capacity. The journey to achieving a Minimum Viable Product (MVP) unfolded over nine months, marking a pivotal step in the company’s growth trajectory.

The fintech sector, while experiencing significant growth, profits, and competitive success in recent years, faces challenges such as market saturation and regulatory pressures.

According to McKinsey, fintechs could see up to 15% revenue growth over the next five years by navigating these challenges effectively. For the post-trade market to capitalize on this opportunity, navigating regulatory hurdles is paramount. Industry experts emphasize the importance of reducing risk and embracing automation to enhance efficiency.

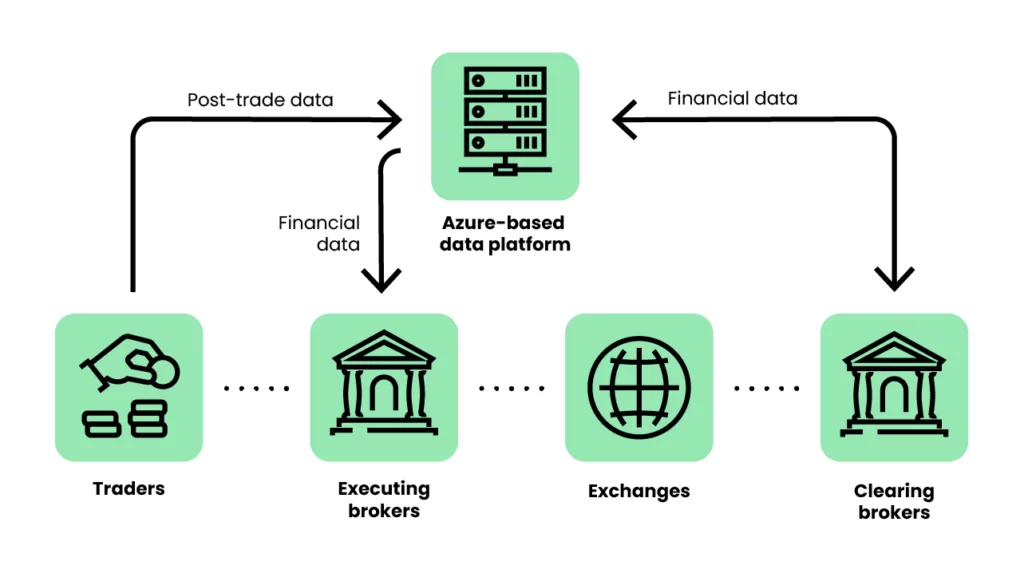

Our client, a seasoned fintech entity, aimed to prepare for these industry shifts. Their flagship offering, a dynamic operational platform, is designed to streamline financial workflows, including allocation and trade matching, with a clear mission to simplify post-trade data management. The platform serves as a centralized hub, consolidating and standardizing transactional data to empower users with informed trading decisions.

With the organization’s plans to expand their customer base from 50 to 200, the existing on-premises system lacked the necessary scalability. The need for a modernized platform was clear, with objectives including greater speed, reliability, and scalability, as well as enhanced user experience.

The company partnered with Scalo to develop a strategic approach to evolving their platform. Our collaboration commenced with an in-depth workshop, allowing us to understand the existing solution and delineate a clear path forward. The project’s scope focused on:

Managing the sheer volume of diverse and real-time data remained the paramount challenge. However, we also had to be mindful of security complexities.

We now work with the client on an extended MVP of the enhanced platform. Focusing on developing Position Management Systems Workflows, our team is dedicated to enhancing the platform’s operational efficiency.

The goal is to enable seamless processing of data within our client’s workflow platform, irrespective of format or financial product type. Our efforts encompass:

The reconciliation spans a wide spectrum of financial data, including trades, positions, cash, commissions, and balances.

By transitioning ETL pipelines to Python for scalable automation and leveraging React for interface development, we’ve ensured a reliable, cloud-based solution that prioritizes data integrity and accessibility.

Prioritizing security, we’re also collaborating with a specialized partner company to ensure restricted access to sensitive data.

A diagram illustrating the platform workflows

The MVP has dramatically transformed how our client’s customers manage and share data, allowing them to concentrate on their core activities. The initial workshop was instrumental in clarifying requirements, ensuring that the project progressed efficiently and effectively from concept to execution.

The efforts on simplifying user interactions have not only aligned with the company’s mission to streamline post-trade processes but have also opened avenues for customers to seize new opportunities with ease.

The new cloud-based system has markedly improved data delivery times, outpacing the previous infrastructure and offering a scalable, robust solution aligned with our client’s growth strategy.

Notably, the shift to cloud computing has not only increased scalability but also dramatically reduced capital expenses by 60% and provides a solid foundation for future expansion and the introduction of additional features.

The project will soon move to the main phase, where the solution is scaled to accommodate new clients and add new functionalities. This transformative endeavor demonstrates our dedication to delivering state-of-the-art solutions that cater to the dynamic demands of the fintech sector.

We take pride in being part of our client’s journey, and their relentless pursuit of innovation and excellence in the ever-evolving landscape of technology and business.

We are thrilled to be part of the process where we empower our client’s customers to effortlessly take control of their data-sharing processes. Through our combined efforts, the platform streamlines and automates the entire post-trade workflow, granting users more time and flexibility to focus on their primary objectives.

Paul Mydlo, Senior Business Development Manager at Scalo