A major European banking institution with multiple subsidiaries.

A major European banking institution with multiple subsidiaries.

In an era where fraud schemes are increasingly sophisticated, financial institutions worldwide are prioritizing the battle against fraud. According to the Nasdaq Verafin report, in 2023, projected losses from fraud scams and bank fraud schemes amounted to a staggering $485.6 billion globally. In turn, Experian’s research indicates that 70% of businesses and over half of consumers have observed a rise in fraud rates.

With the continuous evolution of AI technology and new spoofing methods, these rates are expected to climb even further. This situation places banks under tremendous pressure to enhance their protective measures to safeguard their clients, assets, and reputation.

A leading banking institution, part of an extensive international capital group with numerous subsidiaries in Poland, provides a wide range of financial services to consumers, businesses, and other entities.

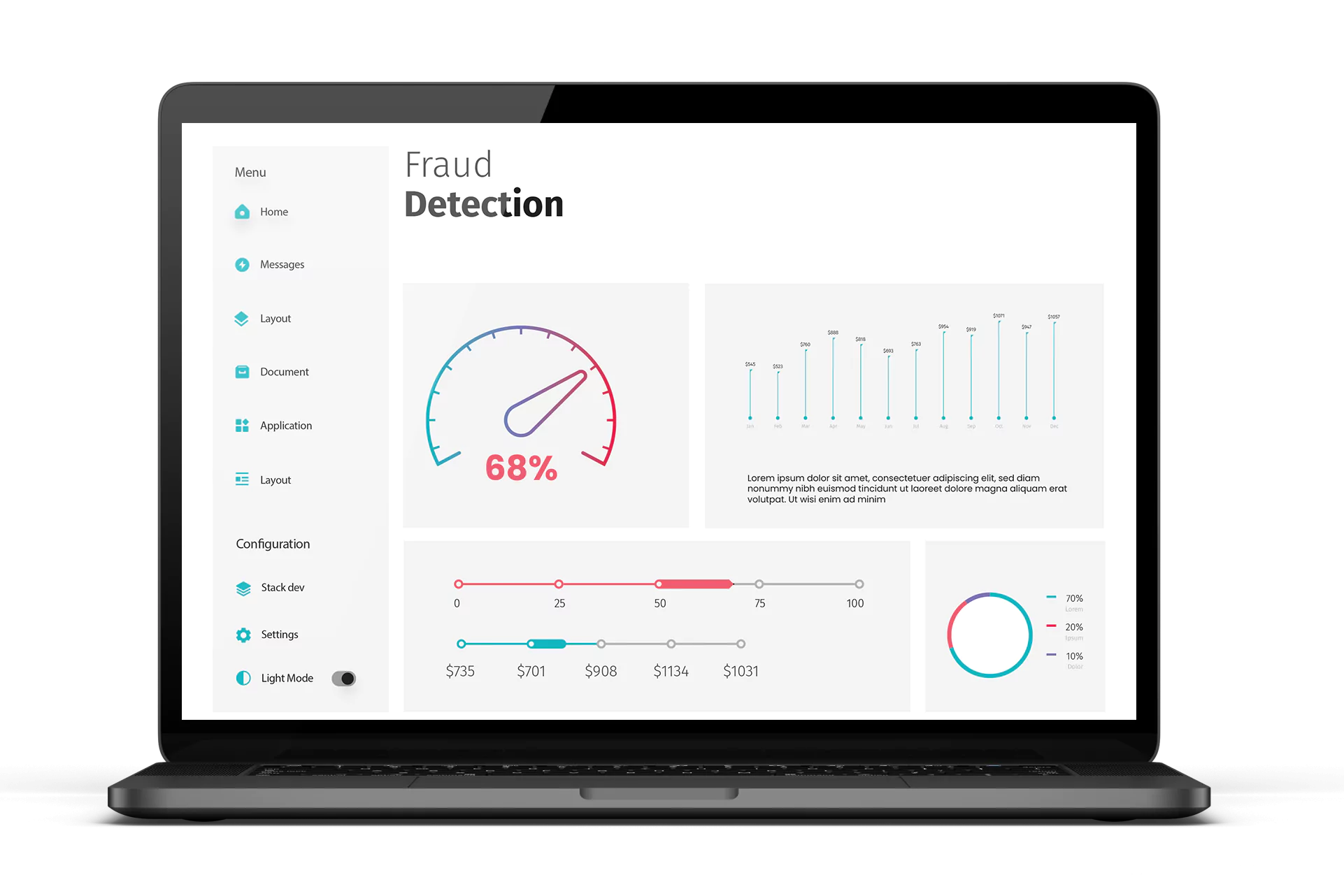

The client sought to overhaul their fraud detection capabilities. This initiative was driven by the need to meet both internal and external requirements, including regulatory standards and the desire to improve internal processes.

The bank aimed to implement a more effective system for reacting to suspected fraud by incorporating automated transaction verification processes. They needed to expand their existing systems to include automated information transfer on suspected fraud, so that the system would not process the suspected transaction.

Recognizing the urgency of the situation, the bank partnered with Scalo to modernize their fraud detection system efficiently. Our team of experts integrated seamlessly with the client’s internal team to tackle the project head-on.

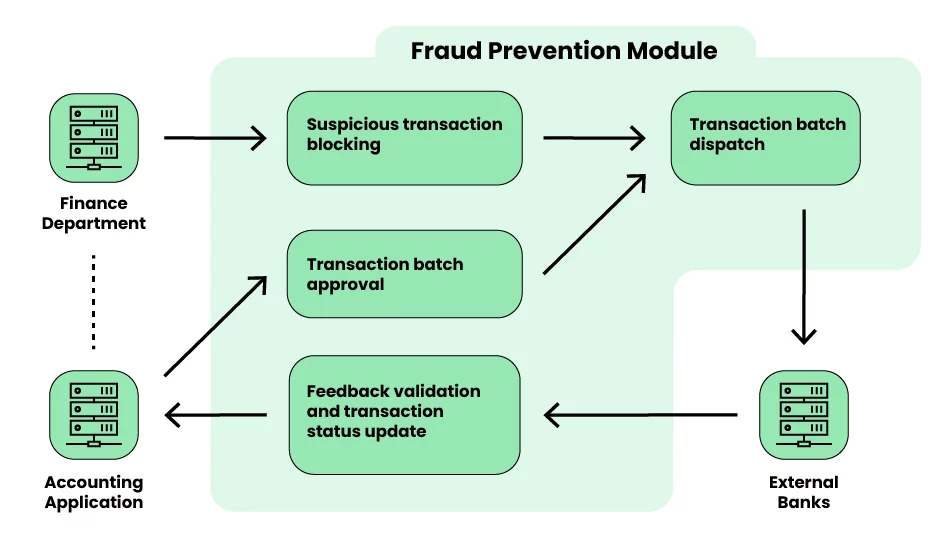

The process involves collecting batches of transactions and sending this information to other banks for processing. The core of the project revolved around ensuring that suspectedly fraudulent transactions were automatically excluded from the transferred batches. This task was particularly challenging due to the reliance of the existing process on a legacy system.

Our solution involved the development of a brand-new batch collection and processing functionality, to be included in the bank’s modern system based on Spring technology. The new process had to be capable of handling transaction data more efficiently and securely.

The solution is designed to streamline and secure transactions while automatically blocking suspicious transfers from processing. At its core, it features:

To ensure the utmost data security and integrity, every event within the system undergoes rigorous verification and validation processes at multiple points.

The application maintains a two-way communication channel with receiving banks, enabling updates on transaction statuses. Each feedback event is also subject to security and validation standards, ensuring that every piece of data remains secure and intact.

An overview of the fraud prevention process incorporating the new module

This project required a collaborative effort from a multidisciplinary team, including software developers, analysts, testers, and a product owner. Due to the sensitive nature of the work, it was imperative to involve stakeholders from various departments, such as compliance, claims, and security.

The engagement was long-term, reflecting the complexity of the challenge at hand. Nonetheless, our team’s dedication and collaborative spirit ensured the successful integration of the new system.

A year after its implementation, the updated anti-fraud banking system has demonstrated remarkable success. Key benefits include:

The success of our cooperation with the bank emphasizes the importance of innovative solutions in the fight against financial fraud. By leveraging technology and fostering collaboration, institutions can protect their customers, and themselves, from the evolving threats in the digital age.

We are committed to supporting the client in their endeavors, ensuring their systems are secure, efficient, and ready to meet the challenges of tomorrow.