The current inflation crisis is making it difficult for everyone to manage their finances, as the rising costs affect people and families globally. Inflation reduces the purchasing power of money, which means individuals can buy fewer goods and services for the same amount.

For instance, if inflation is running at 2%, the cost of goods and services will have increased by approximately 22% after ten years, significantly impacting the purchasing power of savings. It also affects investments, particularly those with fixed returns, such as bonds. For example, if you invest $1,000 in a bond that pays a fixed interest rate of 3%, but inflation is running at 2%, the real return on your investment is only 1%.

This situation highlights how important it is for everyone to get serious about their finances by carefully planning and budgeting.

A Chance for Banks to Introduce Customized Solutions

Even though it’s crucial to be financially savvy in these circumstances, it turns out that only about 25% of Americans have a financial plan written down, and just 30% think long-term about their finances. This gap shows a big chance for banks and fintech companies to offer smart, easy-to-use software that gives personalized financial advice.

This move meets the increasing need for customized financial guidance during these uncertain economic times. It goes hand-in-hand with the growing shift to digital tools for managing personal finances.

The Rise in Demand for Personalized Financial Advice

The recent trend in consumer financial behavior shows a tilt toward careful management and a need for personalized advice from banks and financial service providers. Many consumers expect these institutions to preemptively understand their expectations, a service gap that still exists for most.

A Salesforce study of over 6,000 financial consumers found that 73% expect their financial institutions to anticipate their needs, yet only 37% feel they are being predicted effectively. Digital experience is pivotal, with 25% of customers switching banks for a better one. The research also notes that while consumers prioritize secure data handling, only 55% are satisfied with how their data is used to improve services. These insights point towards a consumer desire to balance innovative digital solutions and reliable, personalized customer service.

While consumers want efficient online systems for daily transactions, they also value human interaction for more complex issues. Institutions that blend personalized service with robust digital platforms will likely increase customer loyalty and stay competitive.

Developing Software to Facilitate Personalized Money Management

The financial sector is undergoing a significant transformation driven by technological advancements and changing consumer expectations. This shift focuses on personalization, with the aim of improving the overall user experience.

The Dilemma of Personal Connection

As banking has shifted from in-branch to digital experiences, there is an emotional gap that needs to be filled. This void has made it more difficult for banks to differentiate themselves and retain customer loyalty. According to Accenture’s Life Trends 2024 survey, 42% of consumers struggle to differentiate between financial services brands, and the average consumer now has products from multiple providers. This indicates a decline in customer loyalty towards their primary bank.

Banks have successfully met their customers’ basic needs through digital capabilities. However, the opportunities for deeper conversations about financial aspirations have decreased. This emphasizes the need for banks to change their digital strategy from simple servicing to engaging in more meaningful conversations that can lead to stronger relationships and increased customer loyalty.

Embracing Digital Conversations

BBVA’s journey exemplifies success in this realm. Thanks to a focused strategy on personalizing digital interactions, they increased digital sales from 25% to 61% over five years. Similarly, Bank of America’s initiative to collect and analyze feedback from over 50 million customer interactions demonstrates the shift towards understanding and catering to individual customer experiences rather than viewing them as a homogenous group.

The Imperative of Personalization

Financial institutions are increasingly using customer data better to understand their customers’ unique financial aspirations and challenges. This focus on personalization goes beyond simply carrying out transactions; it involves creating customized advice and services tailored to each customer’s financial journey.

Think about it: from helping customers plan for retirement to offering investment advice or guiding them through debt management – it’s all about creating a banking relationship that feels personal and relevant.

Advancing Hyperpersonalization through Data Analytics

The key to hyperpersonalization lies in using robust data analytics and artificial intelligence (AI). Banks now use advanced modeling tools to analyze transaction data and provide predictive insights across all customer touchpoints. These tools empower financial institutions to offer richer and more targeted advisory services, treating each customer as a unique segment.

Enhancing User Experience Through Design

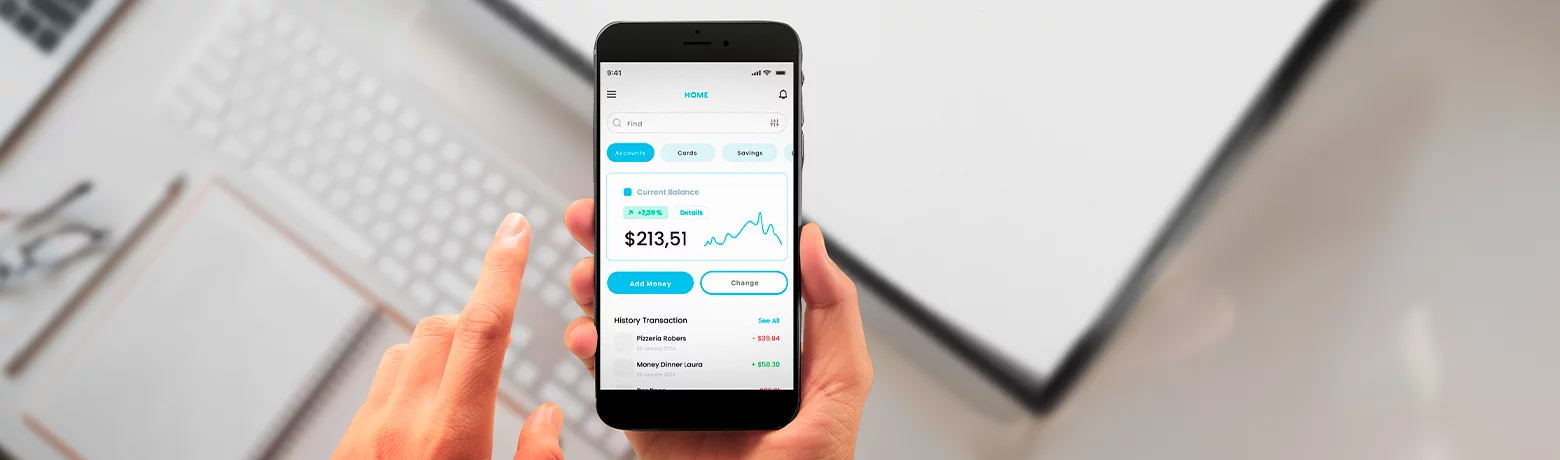

Financial tools’ appearance, functionality, and user-friendliness are undergoing a significant upgrade. The central principles of simplicity, clarity, and a mobile-first approach ensure that financial management tools are easy to use and accessible to a wide range of users.

This commitment to design excellence goes beyond the basics by embracing new technologies such as augmented reality (AR), virtual reality (VR), micro-interactions, and voice user interfaces (VUI), which all contribute to more immersive and engaging digital interactions. Additionally, design trends like 3D design, minimalism, and dark mode are redefining user interfaces and prioritizing visual appeal and user well-being.

Embracing Technological Advances and Innovation

The financial industry continuously strives for innovation, and adopting emerging technologies is crucial in mitigating risks, streamlining operations, and building customer trust.

Initiatives like open banking create a more collaborative financial ecosystem, while digital identity verification and biometrics enhance security measures.

And let’s not forget about generative AI, which is set to revolutionize everything from risk management to customer service, promising a future where banks operate and interact with us in ways we’ve yet to imagine.

Consumer Payments: Adapting to a Digital-First World

Take a glimpse also at the consumer payments industry, and you’ll see a vivid example of this rapid evolution. The shift from cash to digital payments, driven by the convenience of digital wallets and the efficiency of real-time payments, marks a significant turn in how we transact daily.

As banks and payment institutions navigate these developments, they must leverage data analytics, stay abreast of regulatory developments, and innovate to remain competitive in this evolving landscape.

Implementing Change: Steps for Banks and Fintech Companies

To start offering or improving their money management advice software, financial institutions should follow a systematic approach. Here’s a brief outline of actionable steps to guide this process:

1. Initial Data Gathering

- Conduct market research to identify customer needs and regulatory requirements.

- Analyze existing data to pinpoint what advice and features customers value most.

2. Platform Development

- Develop the core features based on insights from data gathering, focusing on usability and regulatory compliance.

- Ensure the platform is scalable and integrates seamlessly with existing banking services.

3. Beta Testing with User Feedback

- Launch a beta version of the software to a select group of users.

- Collect feedback on functionality, user experience, and additional desired features.

4. Continuous Iteration

- Refine and update the software based on user feedback and evolving financial trends.

- Regularly introduce new features and improvements to keep the software relevant and user-friendly.

Our Conclusion

In a world where economic uncertainty is the new normal, keeping pace with what consumers want is critical for financial institutions. Everyone’s looking for financial advice that feels personal and genuinely helpful, especially when navigating through tough times. Here’s where technology shines, playing a pivotal role in delivering that much-needed personalized advice and strengthening customer relationships.

For banks and fintech companies, this is your moment to lean into tech to meet these growing expectations. Whether refining your current tools or building something new, using tech to offer tailored financial insights can set you apart.

Thinking about boosting your money management software game?

Scalo’s here to help. We’re all about crafting tech that makes financial advice personal, helping you connect better with your customers.

Drop us a line to see how we can work together to bring your ideas to life and make a real difference in your customers’ financial journey.